Tax Table

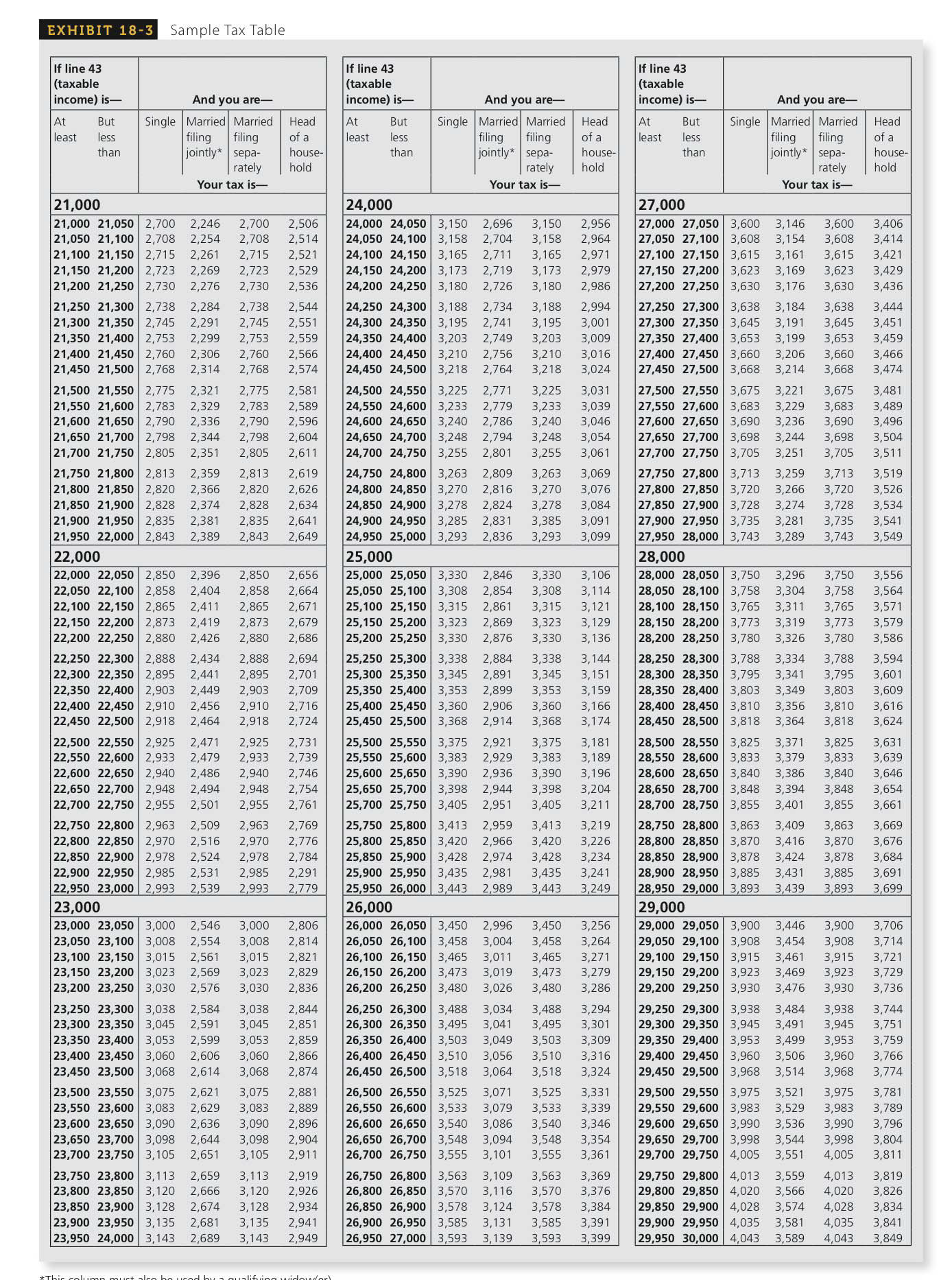

Remember to start with your taxable income which is your adjusted gross income minus your standard deduction or itemized deductions.

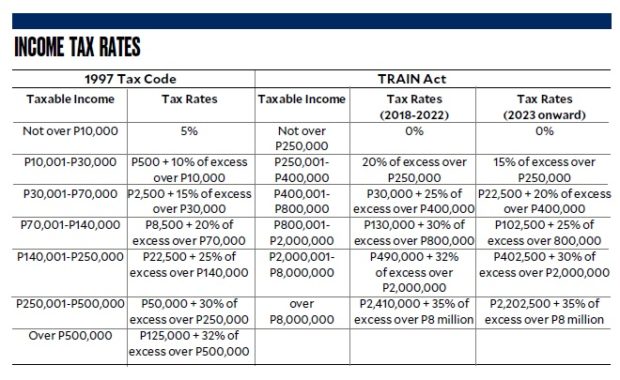

Tax table. The following images are the bir withholding tax tables. Bir train tax tables. Tax credits are a dollar for dollar reduction in your income tax bill. Go to the tax calculator.

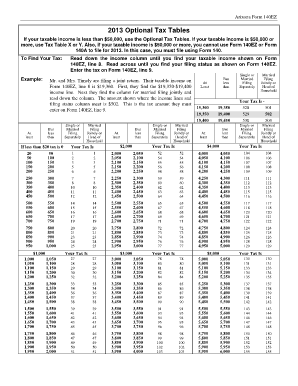

They are not the numbers and tables that youll use to prepare your 2019 tax returns in 2020 youll find them here. 2021 1 march 2020 28 february 2021 weekly tax deduction tables fortnightly tax deduction tables monthly tax deduction tables annual tax deduction tables other employment tax deduction tables no changes from last year 2020 1 march 2019 29 february 2020 weekly tax deduction tables. If you have a 2000 tax bill but are eligible for 500 in tax credits your bill drops to 1500. Tax tables with an have downloadable look up tables available in portable document format pdf.

The link to the pdf is in the get it done section. If you would like a copy of the pdf select the tax table you need and go to the heading using this table. Subsistence allowances and advances. We do currently have the estimated 2019 tax brackets which are for tax returns filed in 2019 for tax year 2019.

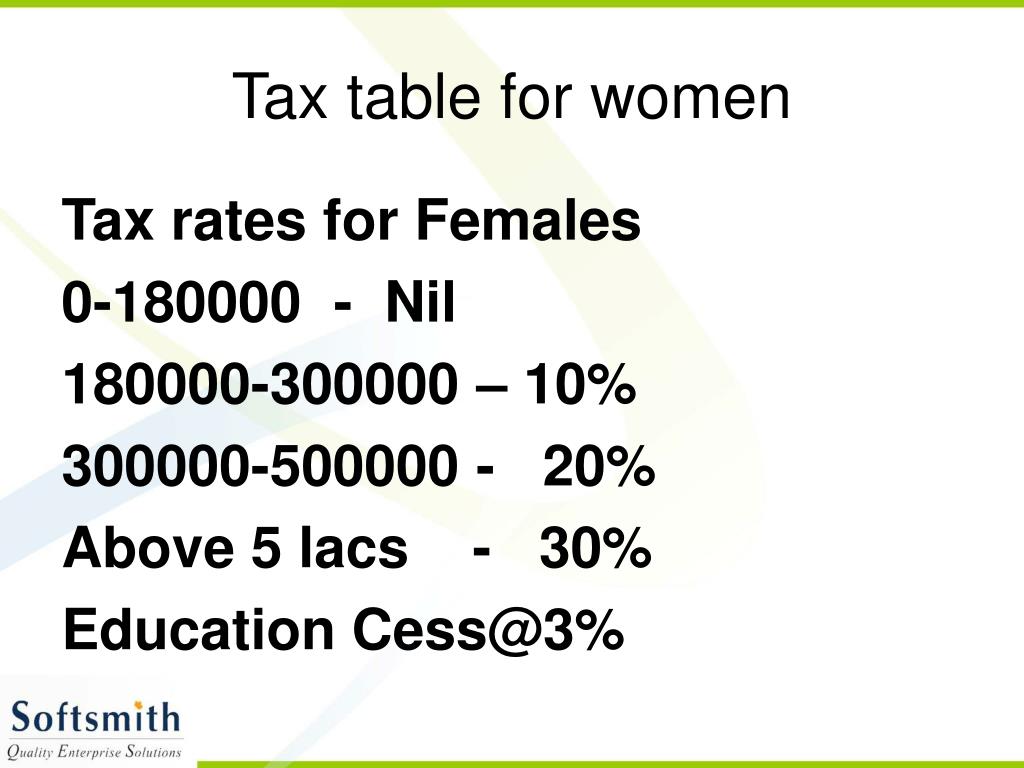

Use this table to calculate the tax rate and tax brackets for filing your 2019 federal income taxes. 2019 income tax brackets and rates in 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows table 1. Please click here for the text description of the image. Medical tax credit rates.

These are the numbers for the tax year 2020 beginning january 1 2020. 2019 federal tax tables the inland revenue service irs is responsible for publishing the latest tax tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year. Tax table see the instructions for line 12a to see if you must use the tax table below to figure your tax. Income tax rates and bands the table shows the tax rates you pay in each band if you have a standard personal allowance of 12500.